BKS mBanka Slovenija

Description of BKS mBanka Slovenija

Advantages and comfort

A comprehensive overview of your personal finances available to you 24 hours a day, every day of the year. You can access your accounts and make payments wherever and whenever.

Basic advantages

• Access to online banking service via a mobile phone app;

• advanced and simple provision of banking services;

• secure and simple use;

• 24/7 viewing possibility;

• quick start-up and use for MyNet online banking service users, without need-ing to visit your branch. Order of mobile tokens straight through the online banking service via your orders option;

• entry and confirmation of payments and orders with the mobile token, which when activated is also used to set your PIN.

The mobile application provides for the following:

• use of a mobile token;

• change in PIN;

• monitoring of balances and transactions on a current account and other ac-tive accounts open at the bank;

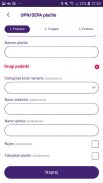

• execution of non-cash payment transactions (entry and monitoring of domes-tic, cross-border and third-country orders);

• execution of payments using the ‘photograph and pay’ function;

• overview of SEPA direct debits transactions;

• overview of e-invoice transactions;

• overview and repayment of loans;

• overview of transactions on savings accounts and specific-purpose premium savings accounts;

• overview of deposits;

• monitoring of daily exchange rates;

• informative currency calculations;

• overview of transactions with MasterCard payment cards;

• sending of various requests and orders; and

• all other services that the bank uses subsequently to upgrade the mobile banking service.

Access security

Secure access to the mBanka mobile banking service is enabled by the secure two-factor authentication that verifies a combination of the mobile device and PIN.

Data and passwords linked to the user’s bank account are never stored on the mo-bile device, but on a highly secured server.

For more information, visit our website at

https://www.bksbank.si/m-banka